We get asked many questions when discussing the benefits of taking online payments:

- What about the charges?

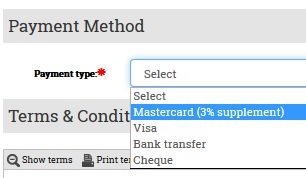

- Should we pass the surcharge on to our guests?

- What do your other customers do?

There are legal implications whatever you decide to do, so make sure you are up to date with

current law.

How many pass it on?

Of our customers that accept card payments, one-third of them do pass on a supplement to their guests to pay. The majority charge between 2% and 2.99%. To be legally compliant, you must take care that your supplement does not exceed the direct cost borne by you.

Looking at the profiles, it’s the owners with fewer properties that are more likely to pass the charge on as a surcharge. Two-thirds (67%) of those that add the supplement on to the amount a guest pays have between one and three properties; 15% have between four and 10 properties; 6% have between 11 and 25 properties and 12% have more than 26 properties.

What if you don’t?

You can encourage your guests to pay by another means. Even if you take the deposit payment by card, you could add a note in your Booking summary, for instance, encouraging guests to pay the balance by bank transfer.

Whatever you do, be open

In a recent article – Two in five Brits wary of travel scams – ‘no hidden fees’ was the top holiday booking trust trigger with 91% of respondents saying this is important to them when making a

decision about booking a holiday through a holiday provider.

So it is really important that whatever you decide to do, you are transparent about any charges your guests will incur. Be sure that all fees and charges are shown separately at the time of booking to avoid guests abandoning placing a booking at that crucial moment.